december child tax credit amount 2021

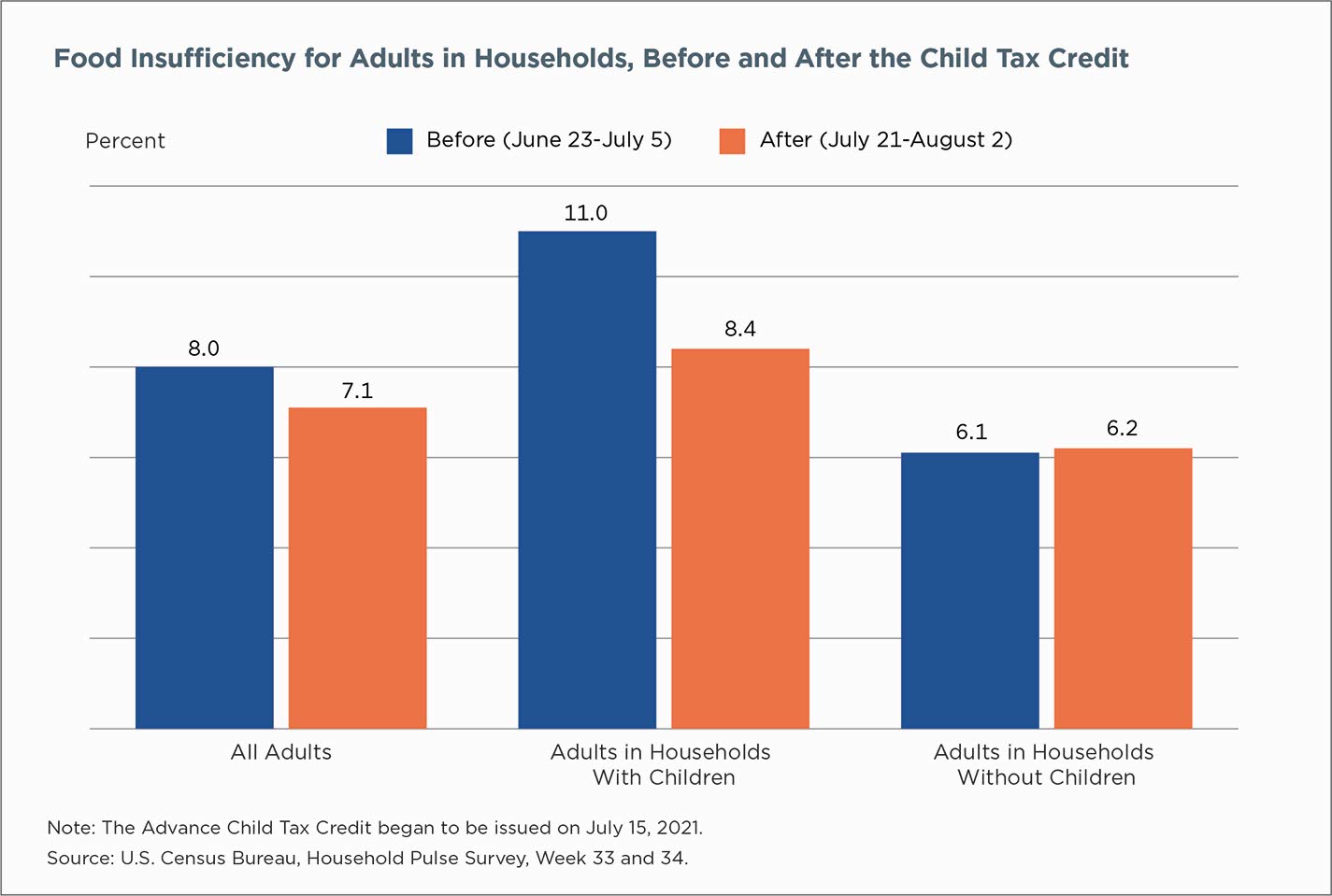

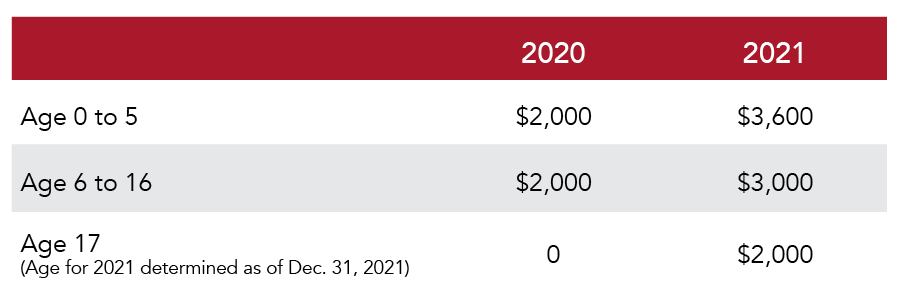

Why have monthly Child Tax Credit payments. Specifically the Child Tax Credit was revised in the following ways for 2021.

Parents Have Just Days Left To Boost Or Opt Out Of December Child Tax Credit Payment Here S How The Us Sun

The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

. The enhanced child tax credit was valid through the end of December 2021 which means that the limits and amounts will revert to the 2020 tax credit rules. The credit amount was increased for 2021. Families that did not receive monthly payments can still claim the full amount of the Child Tax Credit they are eligible for when they file taxes.

Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. 600 in December 2020January 2021. 1200 in April 2020.

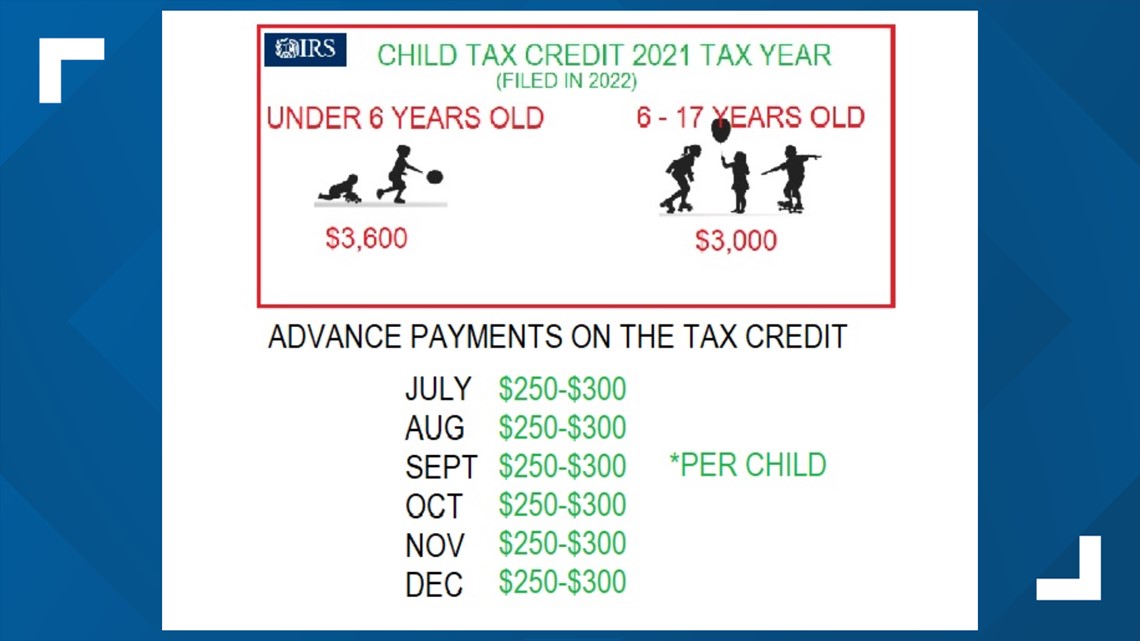

The amount changes to 3000 total for each child ages six. Families with children between 6 to 17 can claim the full amount of 3000 per child if they. If you receive advance payments in excess of the allowable Child Tax.

Increases the tax credit amount. These monthly payments and want to get the full. What Will be the.

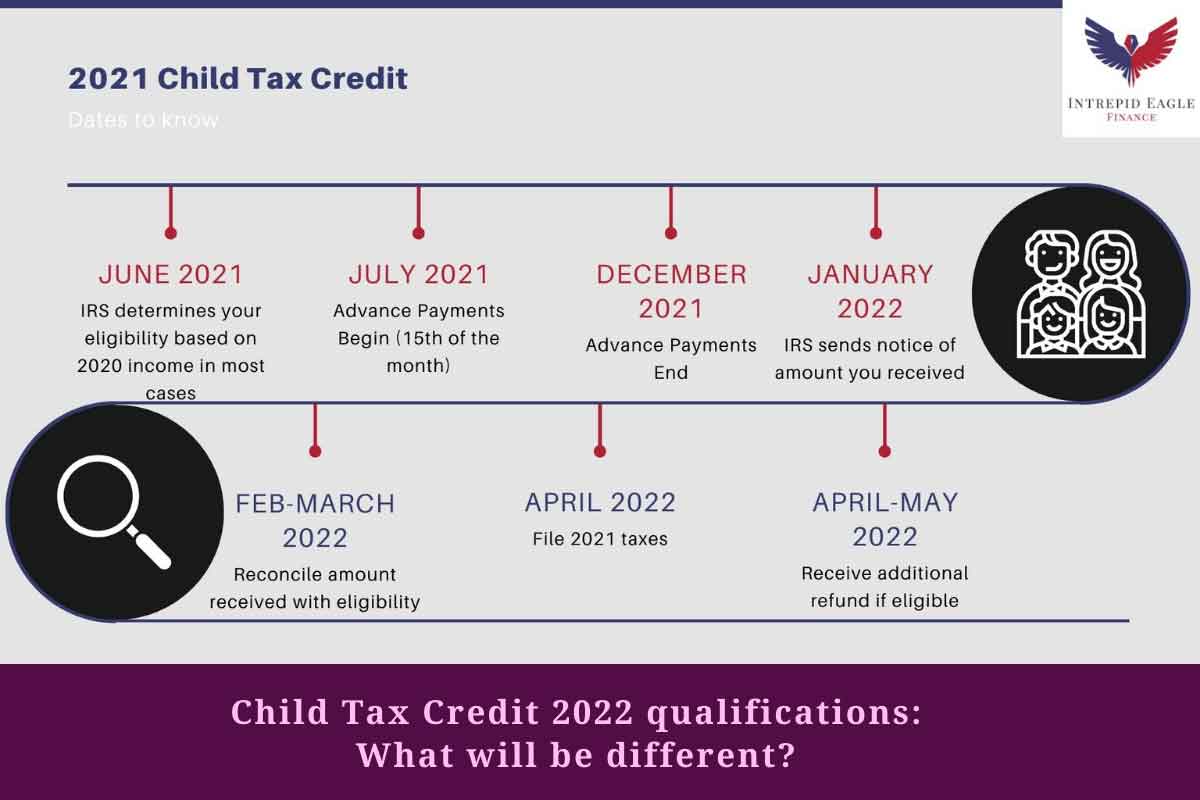

The American Rescue Plan allowed for an increase in the Child Tax Credit for the 2021 tax year. The payment amount is calculated based on an individuals family situation in October 2022 and on their 2021 tax and benefit return. Ad The new advance Child Tax Credit is based on your previously filed tax return.

Most families are eligible to receive the credit for their children. The Child Tax Credit begins to be reduced to 2000 per child if your modified AGI in 2021 exceeds. The Build Back Better Act extends the expanded Child Tax Credit which has been a game changer for working families.

The total deposit amounts from July to December will equal 50 of your 2021 eligible Child Tax Credit. Through December 2021. How much will my 2021 Child Tax Credit amount decrease by if I have a higher income.

The CTC will be reduced to 2000 per. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. For families with children under 6 the full amount of the CTC is 3600 per child.

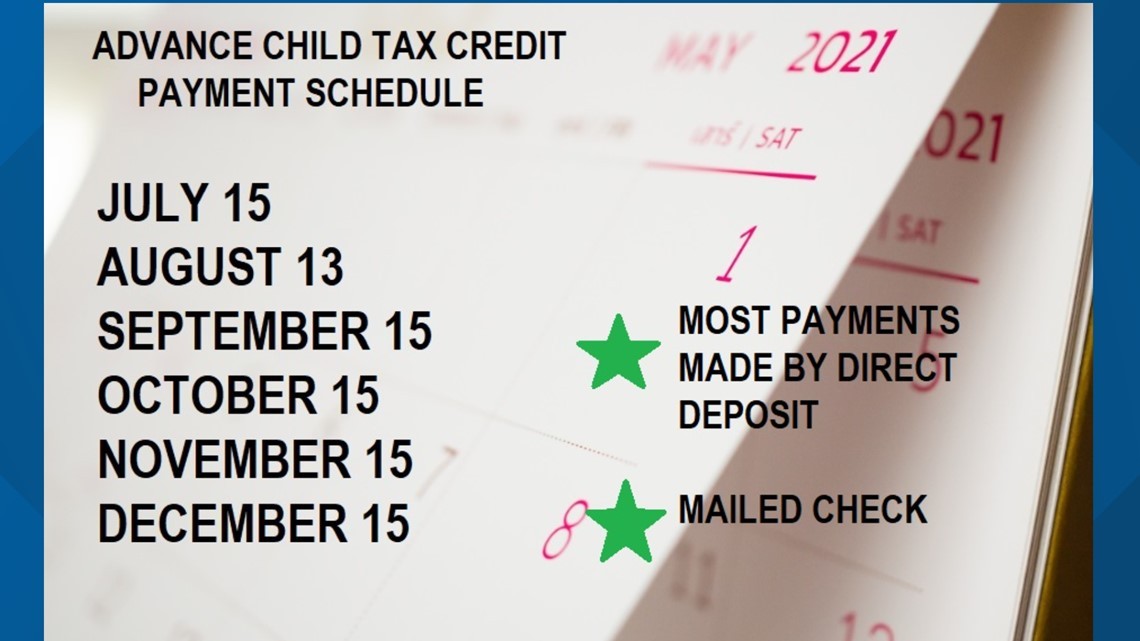

Register and Subscribe Now to work on SBP Election Stmt for er more fillable forms. Therefore any families expecting to receive the payment of 250 to 300 per child on December 15 could see this be their last monthly Child Tax Credit payment. Discover Helpful Information And Resources On Taxes From AARP.

The advance is 50 of your child tax credit with the rest claimed on next years return. The tax credits maximum amount is 3000 per child and 3600 for children under. The full credit is available for heads of households earning up to.

Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their joint-filing parents earn less than. It helped roughly 60 million children and helped cut child. Eligible families and individuals could.

For families with qualifying children who did not turn 18 before the start of this year the 2021 Child Tax Credit is. In total the expanded credit provides up to 3600 for each younger child and up to 3000 for each older one. The American Rescue Plan increased the amount of the Child Tax.

The 2021 CTC will be reduced in two steps. 150000 if you are married and. Ad pdfFiller allows users to Edit Sign Fill Share all type of documents online.

150000 if married and filing a joint return or if filing as a qualifying widow or.

Fact Sheet Advance Child Tax Credit

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

What You Need To Know About The Expanded Child Tax Credit For 2021

First Phase Ending For Child Tax Credit A Game Changer For Families

Child Tax Credit Updates Why Will December Payments Be Bigger Than The Others Marca

Dependent Children 2021 Tax Credit Jnba Financial Advisors

How Much Money Will Families Have Received From Child Tax Credit By December 2021 As Usa

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

All You Need To Know About The New Child Tax Credit Change

Families Saw Less Economic Hardship As Child Tax Credit Payments Came

Child Tax Credit December How To Still Get 1 800 Per Kid Before 2022 Marca

2021 Child Tax Credit What Should I Know Collins Consulting

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Stimulus Update Some Families Will Get 1 800 Child Tax Credit In December Al Com

Child Tax Credits To End Dec 31 Unless Dems Pass Build Back Better Act Katv

December Child Tax Credit Date Here S When To Expect 1 800 Stimulus Check